Presentar impuestos no es fácil, especialmente cuando uno no es un profesional de preparador de impuestos o actualizado con las últimas leyes fiscales.

Dependiendo del estado en el que viva y presente su declaración, edad, ingresos y otros factores, las reglas fiscales varían de año en año y de persona a persona.

Filing taxes is not easy, especially when you aren’t a tax professional or up to date with the latest tax laws.

Depending on your filing status, age, income and other factors, tax rules vary from year to year and from person to person.

CONDADOS DE LOS ANGELES, ORANGE, SAN BERNARDINO Y RIVERSIDE

TAX TIPS

22/FEBRUARY - I Receive Social Security Benefits. Should I File a Tax Return?

As the April 18 tax return filing deadline starts to get closer, Social Security recipients might be wondering whether they should file a tax return this year. Whether it’s necessary for Social Security beneficiaries to actually file a tax return depends on a few factors.

![]()

10/FEBRUARY - Are Your Social Security Benefits Taxable?

The Social Security Benefit Statement helps you figure out whether your benefits are subject to tax..

![]()

17/FEBRUARY - Are Your Social Security Benefits Taxable?

Use Form 5695 to figure and take your residential energy credits. The residential energy credits are:

![]()

3/FEBRUARY - Credits for New Electric Vehicles Purchased in 2022 or Before

If you bought a new, qualified plug-in electric vehicle (EV) in 2022 or before, you may be eligible for a clean vehicle tax credit up to $7,500 under Internal Revenue Code Section 30D.

![]()

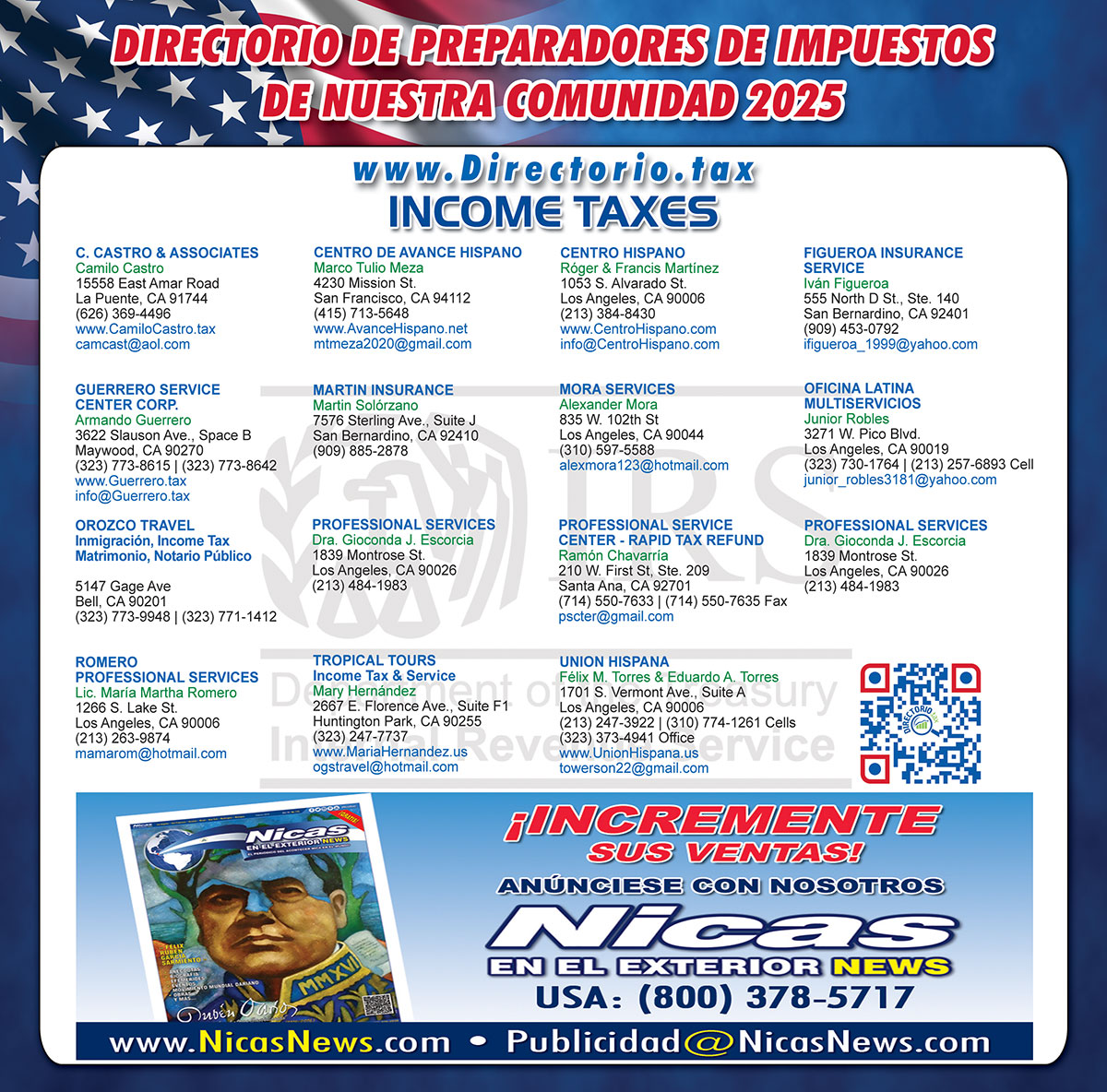

PREPARADORES DE IMPUESTOS (INCOME TAX) 2️⃣ 0️⃣ 2️⃣ 5️⃣

Suscríbase a Nuestro Boletín

Boletín de Información General de Nicaragua y los Nicas En El Exterior.

GRACIAS por Subscribirse!

![]()